Demat account

- Credited with shares purchased

- Debited with shares sold

Trading account

- Debited with purchase price

- Credited with sale proceeds

What is a trading account?

You will need both demat and trading accounts to trade in the Indian stock markets. While the demat account helps in storage of digital (electronic) assets like shares, mutual funds, bonds, debentures, ETFs, and gold bonds, the trading account facilitates the actual buying and selling of these assets in the exchanges.

Why open an m.Stock trading account?

You can too. Here’s how!

| Segment | m.Stock | Discount Broker | Traditional Broker |

|---|---|---|---|

Intraday 960 orders | ₹0 | ₹19,200 | ₹48,000 |

Options 24,000 orders | ₹0 | ₹48,000 | ₹1,80,000 |

₹50,000/order in intraday & 20 working days per month

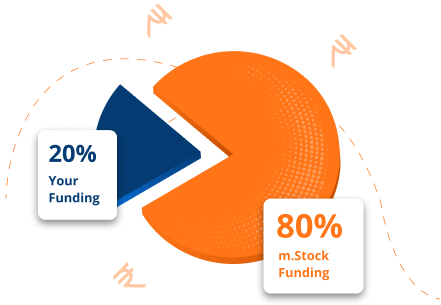

4X Investments with

Pay Later (MTF)

Place big equity delivery orders on 700+ stocks

Interest starting

6.99% p.a.

Holding period

Unlimited

₹78+ crore MTF interest saved by over 78,664 users

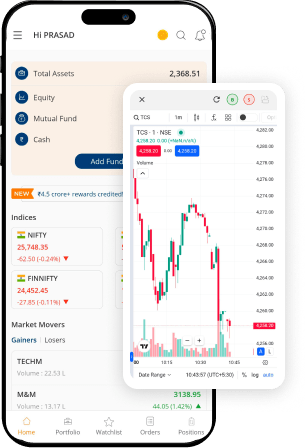

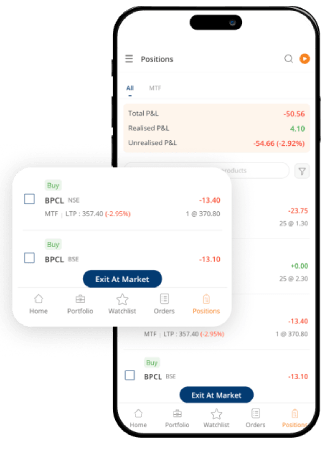

Powerful. Stable. Secure. Trading platform

Trade from charts real time

Place seamless orders from TradingView charts

Advanced option chain

Take informed trading decisions using real-time options data

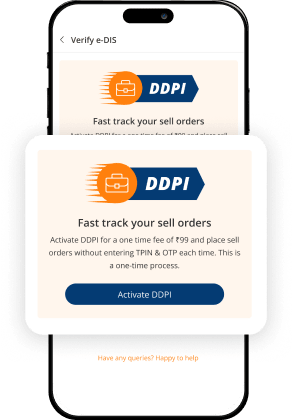

Fast-track your sell orders

Activate DDPI and sell holdings in 1 click, without having to authorise each time

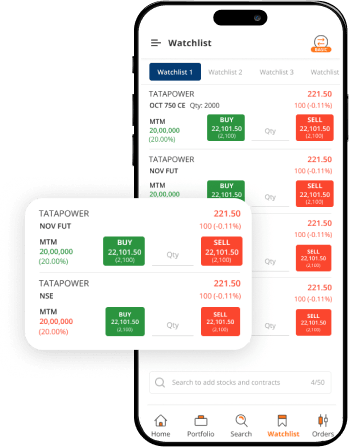

Watchlist PRO

Execute 1-click orders directly from watchlist

Advanced order types

Optimise trading experience with Basket, GTT, Stop-loss, Cover Order, AMO & more

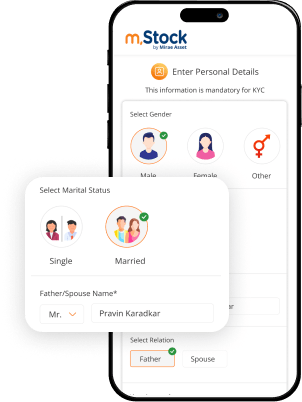

3 simple steps is all it takes

- 1

Enter personal details

- 2

Complete your documentation

- 3

Login and start investing

- Uninterrupted experience7,467 trades/min

- Efficient trading20+ tools

- Bank grade security100% secure

20,000

Trusted positive reviews

50 lakhs+

App downloads

FAQs

What is the difference between Demat and trading account?

A Demat and trading account are both mandatory requirements for trading in the stock market in India. However, contrary to popular belief, they are 2 separate accounts and serve different purposes. While a Demat account is quite similar to a bank account and is needed to hold/store securities such as shares, ETFs, mutual fund REITs, etc. in a digital format, a trading account is required to buy and sell them on the stock exchange.

Both these accounts work in tandem and are usually linked to each other for seamless trading. However, it is also possible to open a Demat account alone if the idea is just to store your securities for the long term. Similarly, it is also possible to open a trading account alone and trade in futures and options, as this form of trading does not require taking the delivery of the stocks, hence not requiring a Demat account.

How to trade online using trading account?

Why is a trading account important?

How do I know if m.Stock trading account is right for me?

Using its free demat account you can freely trade as much as you want without worrying about trading or per transaction charges. With m.Stock, you also get free AMC. The amazing part is that m.Stock is not just a trading app. It also allows you to invest in direct mutual funds conveniently via a SIP or even as a lumpsum amount. Always available through the web portal and smartphone app and supported by an ever-reliable customer support team, m.Stock is clearly one of the best stock market apps in India.