the lowest interest rates

Up to ₹25 lakh

0.0411% (14.99% p.a)

₹25 lakh to 5 crore

0.0274% (9.99% p.a)

Above ₹5 crore

0.0192% (6.99% p.a)

What is Pay Later (MTF)?

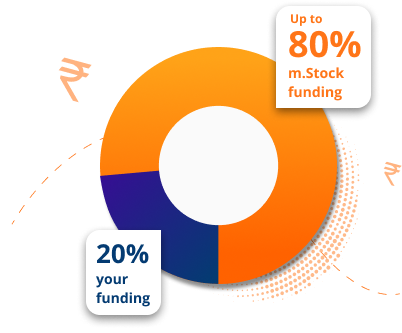

MTF is a equity delivery funding product where you can get additional capital for investing from the broker. With m.Stock, you get up to 80% funding instantly in 1,100+ stocks at one of the lowest interest rates starting from 6.99% p.a. (0.0192% per day).

- Available Margin₹1.75 crore

- m.Stock Pays₹5.26 crore

- You can buy stocks worth₹7.02 croreInterest rate

applicable6.99%

The Pay Later (MTF) advantage with m.Stock

- Low haircut. High funding

(Up to 80%) - Unlimited holding period

- ₹0 cash MTF orders

using Pledge - Zero subscription fees

- Instant funding to buy

Stocks & ETFs - MTF ledger for 100% transparency

Big savings on MTF interests!

Top Saver

Mr. Rajeevan

Kerala

₹62,47,016

Top Saver

Ms. Lunkad

Gujarat

₹44,74,700

Top Saver

Ms. Sharma

Delhi

₹39,02,752

Calculate your returns with MTF

Pay Later (MTF) vs Pledge Shares

| Differences | Pay Later (MTF) | Pledge Shares |

|---|---|---|

| Purpose | Allows leveraging on available fund | Allows using existing holdings as collateral |

| Collateral required | None | Existing shares in the Demat account |

| Interest charges | Charged on the overall funding | Charged on the margin utilised |

| Risk of charges | Based on purchased stock performance | Higher in volatile market conditions |

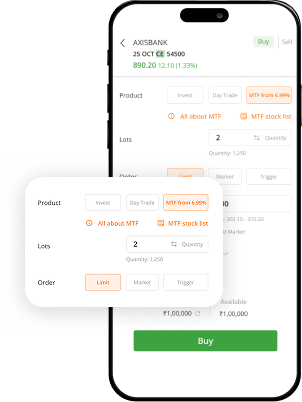

Avail Pay Later (MTF) with m.Stock in 3 quick steps

- 1

Select stock and enter quantity

- 2

Select Pay Later (MTF)

- 3

Place your BIG order

Growing popularity of m.Stock Pay Later (MTF)

- 93,000+active MTF users

- ₹1,800 crore+MTF book (peak)

- ₹78 crore+MTF interest saved

FAQs

Margin Trading Facility (MTF), is a product where you get funding from m.Stock for buying stocks in the share market. This facility is exclusively for delivery trades only. m.Stock offers up to 80% funding on more than 1070+ stocks with interest as low as 6.99% annually. The Pay Later (MTF) facility has no subscription fees or hidden charges and is absolutely free with your m.Stock Demat account.