What is the process of IPO allotment?

An Initial Public Offering (IPO) allotment divides a company's stock into a specific number of shares that are sold to the investors. The IPO allotment status allows the investors to know whether they have been allotted any shares against their bids as well as the quantity of shares allotted to them.

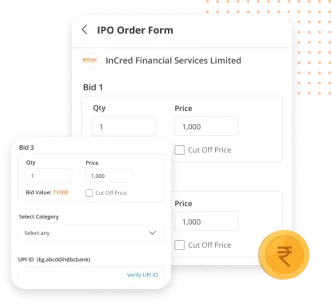

InCred Financial Services Limited

Listing date: 13/01/2023

Aristo Bio-Tech and Lifescience Limited

16 - 19 Jan

Indiabulls Commercial Credit Limited

5 - 27 Jan

IPO allotment status

- IPO was subscribed 1.0941X times in retail category

Issue Date

28 Feb - 04 Mar

Issue Price

₹ 66 - ₹ 70

- IPO was subscribed 1.8541X times in retail category

Issue Date

20 Feb - 24 Feb

Issue Price

₹ 108

- IPO was subscribed 1.8316X times in retail category

Issue Date

14 Feb - 18 Feb

Issue Price

₹ 401 - ₹ 425

What is the process of IPO allotment?

The IPO allotment process takes place in the following stages:

- 1Investor applies for any IPO through their broker or bank

- 2Over subscription assessment by the registrars

- 3Verification of share allotment against successful bidders

- 4Share allocation usually within 7-10 days of last bidding

- 5Investors are informed of their allotment status

- 6Refunds are processed against unsuccessful bids

How to check IPO allotment status?

You can check IPO allotment status via:

- m.Stock App

- Menu

- Products

- IPO

- Order Book

FAQs

How do I get allotted shares in an IPO?

What happens if IPO is not allotted?

Why is an IPO not allotted to me?

Some common reasons why your IPO might not get allotted are:

- IPO oversubscriptions

- Computerised lottery

- Invalid applications and in cases where IPO bid price is lower than the issue price