- ₹5 brokerage: Intraday, F&O, and MTF

- ₹0 brokerage: Delivery, IPO, ETF & MF

- ₹0 account opening fee

- ₹0 AMC

- ₹5 brokerage: Intraday, F&O, and MTF

- ₹0 brokerage: Delivery, IPO, ETF & MF

- ₹0 account opening fee

- ₹0 AMC

Market Watch

As of 14 April 2025 | 01:00 AM

| Name | Price | Change (Change %) | Open | High | Low | Pre. Close |

|---|

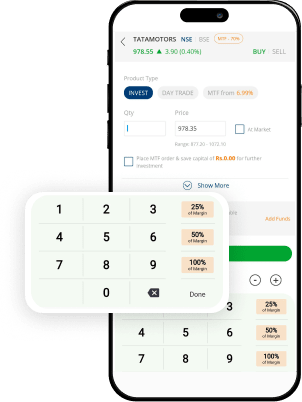

Powerful. Stable. Secure. Trading platform

- Smart order formBuy & sell quickly with smart filters

- Watchlist PROPlace 1-click orders from watchlist

- Trade from charts real timeOrder from live TradingView charts

- Advanced order typesPlace Basket & GTT orders, AMO & more

- User trading insightsView most traded scrips on m.Stock

Efficient trading: 20+ tools | Assured safety: World-class security

Market News

Commodity Futures - Mid-session commentary

Hot commodities: Silver gains 2% as weak dollar and trade tensions fuel rally

11 April 2025 | 3:33 PMCommodity Futures - Pre-session commentary

Indian Rupee: Seen benefiting from tariff pause; dollar weakness under 100 mark

11 April 2025 | 9:20 AMCommodity Futures - Pre-session commentary

Indian Rupee: Extends downside amid rising global tensions

9 April 2025 | 9:15 AM

FAQs

What are currency derivatives?

What are the different types of Currency Derivatives?

In India, currency derivatives are categorized into two types.

Currency Futures: In a Futures Currency Derivative contract, traders typically lock in a fixed, predetermined price for a specific currency to buy or sell on a fixed, future date. The trading price is locked irrespective of the market price of that currency in the open market at the time of contract maturity. Traders must thus buy/sell the specific currency on the fixed future date per the locked-in price and not the market price when the contract matures.

Currency Options: Unlike futures contracts, where traders are obligated to buy/sell currency derivatives at a fixed price on a predetermined date, currency options are more flexible. While traders can buy or sell currency assets at a fixed, predetermined price on a specified future date, they have the right or option not to trade the currency at the time of contract expiration. As such, if the currency rates are higher on the expiration date, they may opt out of the agreement. They must, however, forfeit the margin paid to the seller. Most currency traders generally combine the two currency derivatives types to ensure portfolio diversification and risk management.

How is trading currency derivatives advantageous?

Trading currency derivatives prove advantageous because they help traders to adapt to market fluctuation through hedging, speculating, leveraging, and arbitrage.

- Hedging allows traders to monitor their risk exposure by combing futures and options and protect themselves from the price volatility of exchange rates of foreign currencies.

- By speculating, traders can monitor the price movement directions of currency assets in the future, allowing them to take appropriate trading positions.

- While trading currency derivatives, traders typically pay only a small 5% to 10% margin of the total contract value in order to gain exposure to significant capital, which they may not have access to otherwise. This is known as leveraging.

- Arbitrage allows traders to make money or book profits on the price difference between foreign exchanges of a particular currency. They can book the profits by buying currencies on one exchange and selling them through another.