What are Futures & Options?

In Futures contracts, buyer and seller agree to trade the underlying asset at a predetermined price on a specific future date. Options contracts provide the buyer the right, but not the obligation, to buy or sell the underlying asset at a specific price on or before the expiry date.

m.Stock offers seamless web and app platforms with advanced features for faster trade execution.

- 20+tools

- Real-timedata

- 24*7assistance

F&O trading made smarter with m.Stock

- Unlimited F&O orders at just ₹5/order

- Real-time data on OI & most traded F&O contracts

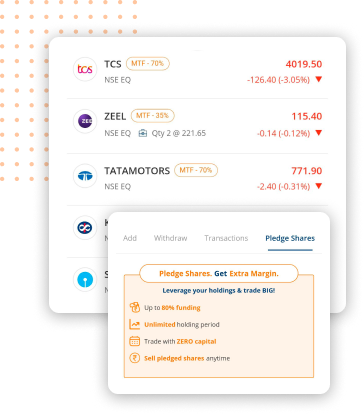

- Pledge shares & get up to 87.50% margin for unlimited holding period

- ₹0 Account Opening fee

- Powerful TradingView charts with 80+ indicators

- Superfast execution with Options Strategy BuilderComing Soon

Powerful. Stable. Secure. Trading platform

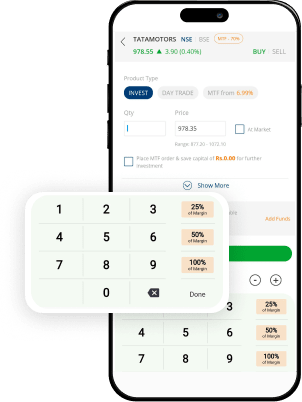

- Smart order formBuy & sell quickly with smart filters

- Watchlist PROPlace 1-click orders from watchlist

- Trade from charts real timeOrder from live TradingView charts

- Advanced order typesPlace Basket & GTT orders, AMO & more

- User trading insightsView most traded scrips on m.Stock

Efficient trading: 20+ tools | Assured safety: World-class security

Over ₹650 crore brokerage saved!

Top Saver

Mr. Khurana

Delhi

₹63,86,702

Top Saver

Mr. Sawant

Maharashtra

₹50,43,556

Top Saver

Mr. Kanoj

Maharashtra

₹42,96,804

Start your savings today

OI Gainers & Losers

- Index

- Stock

| No Record Found | |||||

| No Record Found | |||||

What are the different types of

Options contracts?

There are 2 basic types of Options contracts

Broadly, these contracts can be traded via 2 strategies as mentioned below

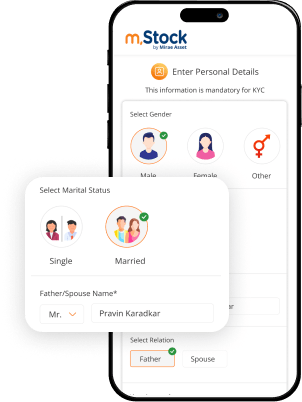

3 simple steps is all it takes

- 1

Enter personal details

- 2

Complete your documentation

- 3

Login and start investing

FAQs

What are Futures and Options Trading Contracts?

How are Futures and Options Trading Contracts different?

How can I trade in Futures and Options, and what do I need?

How to place an F&O trading order?

Login to your DEMAT and trading account , look for the Futures and Options tab and follow the steps by filling the form. You can find the place order or similar tab where you must enter the stock code (available on the internet). You will find the different F&O trading contracts, and you can choose one by clicking the buy/sell link. You will be redirected to a new page where the basic contract details will be auto-populated, based on whether you choose Futures or Options Trading. You must decide the order type - market or limit order, order validity period or maturity date, limit price, and stop-loss trigger price. Once you enter these details, your order will be placed.