What is IPO subscription?

IPO subscription indicates how much a particular public issue has been subscribed at both BSE and NSE. Investors can bid for IPO shares on either of the exchanges through the m.Stock app. We provide real-time subscription updates for ongoing IPOs and final bidding details for all IPOs. When a privately held company goes public, it raises funds by offering shares through an IPO. Keeping a track of the IPO subscription status helps investors to gauge the trend in listing gains of the IPOs.

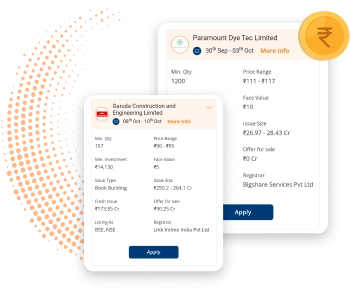

IPO Subscription Status List

| Name | QIB | NII | Retail | Total | |

|---|---|---|---|---|---|

21 Nov | 0.00 | 0.00 | 0.00 | 0.00 | |

27 Dec | 0.00 | 0.00 | 0.00 | 0.00 | |

05 Feb | 0.00 | 0.00 | 0.00 | 0.00 | |

02 Apr | 0.00 | 0.00 | 0.00 | 0.00 | |

30 Apr | 0.00 | 0.00 | 0.00 | 0.00 | |

02 May | 0.00 | 0.00 | 0.00 | 0.00 | |

Iware Supplychain Services Ltd 30 Apr | 0.00 | 0.00 | 0.00 | 0.00 | |

03 Sept | 0.00 | 0.00 | 0.00 | 0.00 | |

25 Apr | 0.00 | 0.00 | 0.00 | 0.00 |

FAQs

Why is IPO live subscription data important for investors?

It helps understand the demand of the IPO as higher demand usually results in better listing gains.

The IPO Grey Market rates movement depends on the IPO Subscription Data.

What different categories do IPO investors fall under?

- RII: Retail Individual Investor

- NII: Non-institutional bidders

- QIB: Qualified Institutional Bidders

- Employee

- Others (i.e., shareholders)

How to check live subscription status of IPOs?

Both NSE and BSE provide live IPO subscription status on their website for the bids received by them. A privately held company to raise funds files a DHRP with SEBI for an IPO. Upon approval, it gets listed at stock exchanges by offering its shares (via fresh issuance or offer for sale) through Initial Public Offer IPO.

What is over subscription in IPO?

Oversubscription in an IPO occurs when the demand from investors surpasses the number of shares available for purchase.

How do I know if my IPO is oversubscribed?

Investors have the option to review the IPO subscription status on both the NSE and the BSE websites to determine whether or not an IPO is oversubscribed. If the number of bid offers exceeds the shares offered by the issuer, the IPO is considered oversubscribed. Additionally, an IPO is deemed oversubscribed when its subscription time exceeds 1.