Here's what you pay with an m.Stock account

₹0

Brokerage on Equity Delivery, MF, IPO

₹0

Account

opening fee₹0

Account

maintenance fee₹0

Pledge creation charges on existing holdings

₹0

Charges on call & trade service

One of the lowest brokerage fees, ₹5/order on Intraday, Futures & Options, MTF, Currency

Over ₹650 crore brokerage saved!

Top Saver

Mr. Khurana

Delhi

₹63,86,702

Top Saver

Mr. Sawant

Maharashtra

₹50,43,556

Top Saver

Mr. Kanoj

Maharashtra

₹42,96,804

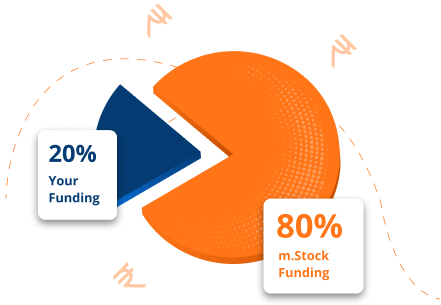

4X Investments with

Pay Later (MTF)

Place big equity delivery orders on 700+ stocks

Interest starting

6.99% p.a.

Holding period

Unlimited

₹78+ crore MTF interest saved by over 78,664 users

Transparent pricing. Innumerable benefits.

No account opening fee | No order limit | No subscription fee

- Equity

- Pay Later (MTF)

| Charges | Equity Delivery | Equity Intraday | Futures | Options |

|---|---|---|---|---|

| Brokerage | ZERO | ₹5 per order | ₹5 per order | ₹5 per order |

| Call & Trade Charges | ZERO | ZERO | ZERO | ZERO |

| STT/CTT |

|

|

|

|

| Transaction Charges |

|

|

|

|

| SEBI Charges |

|

|

|

|

| Stamp Charges |

|

|

|

|

| GST on Other Charges |

|

|

|

|

Payment Gateway Charges - Margin Fund Transfer

UPI & Smart Pay Transactions are Free and in case of Net banking, charges will vary between ₹7 - ₹11 + GST depending on the bank selection

Corporate Action Order Charges

No charge will be applicable for corporate action order

Off-market Transfer Charges

No charge will be applicable

Demat per certificate

No charge will be applicable for demat per certificate

Remat Charges

No charge will be applicable for remat

Failed Instruction Charges

No charge will be applicable for failed instruction

Reactivation Charges

No charge will be applicable for account reactivation

Modification charges

No charge will be applicable for modification

Physical Delivery of Derivatives

No charges will be applicable for physical delivery of derivatives

Physical CMR Request

No charge will be applicable for physical CMR request

Account Closure Charges

No charge will be applicable for account closure

Mutual Fund Charges

No fees on Mutual Fund Direct Plans

DP (Depository Participant) Charges

₹18 + GST per ISIN per transaction per day will be charged as DP charges for sell transactions charged by CDSL & m.Stock

Pledge Charges for Pay Later (MTF)

Pledge creation & closure charges will be ₹32 per PSN (Pledge Sequence Number) per day (+GST).

Pledge Charges for Pledge Shares

Pledge creation & closure charges will be ₹0 & ₹32 respectively per PSN (Pledge Sequence Number) per day (+GST).

Pledge Shares interest rate will be 0.0274% per day.

Quarterly Operating Charges

₹219 + GST per quarter for clients

Clients can opt for 'Lifetime free operating charges' by paying a one-time fee of ₹1,299 + GST once their account is activated

Upgrade Charges

Operating Charges: You have an option to upgrade to ‘Lifetime free operating charges’ later, by paying a one-time fee of ₹1,299.

Delayed Payment Charges

Interest is levied at 0.066%/day on the debit balance in your trading account

Physical Statement Courier Charges

₹100 per request + ₹100 per courier

Investor protection funded trust

Equity: ₹10 per crore

Options: ₹50 per crore

18% GST

On Brokerage, DP charges, Exchange Transaction charges, SEBI charges and Auto Square-Off charges

Transaction/Turnover Charges

BSE transaction charges on securities traded in X, XT and Z group is 0.10% per crore & for 'P', 'ZP', 'SS' and 'ST' group, it is 1% per crore on the gross turnover value

RMS Square-off

RMS square-off-charges for open intraday positions by system - ₹100 per position

Auction charges:

Auction if unable to deliver a stock (not in demat) - As per actual penalty by exchange