Unlimited trades @ ZERO brokerage

Delivery | IPO | Mutual Funds

- NOorder limit

- NOsubscription fee

- NOAMC

₹650 crore+ brokerage saved in just 2 years

Unlimited trades

@ ZERO brokerage

Delivery | IPO | Mutual Funds

Start today with ZERO account opening fee!

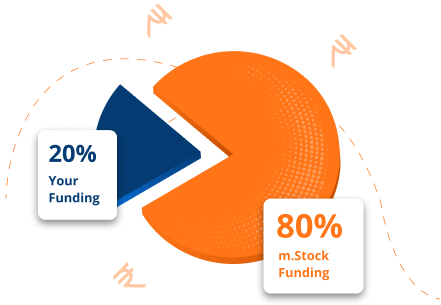

4X Investments with

Pay Later (MTF)

Place big equity delivery orders on 700+ stocks

Interest starting

6.99% p.a.

Holding period

Unlimited

₹78+ crore MTF interest saved by over 78,664 users

“My account opening process on m.Stock trading app was incredibly simple. A hassle-free investment with mstock demat account”

Tax Guru

m.Stock customer, Mumbai

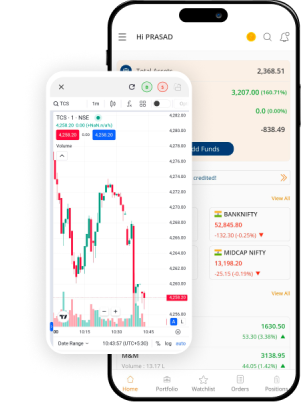

Powerful. Stable. Secure.

Elevate your trading experience

- Trade from charts real time

- Watchlist PRO

- Advanced order types

- Bulk exit

- Advanced option chain

Invest. Trade. Prosper.

One platform for all your needs

m.Stock, a Mirae Asset brand

Continuing the legacy of delivering innovative financial solutions across 12 countries since 26+ years!

- Trusted by17 lakh+ users1 user onboarded every 50 sec

- Facilitated80 crore+ trades7,467 trades/min

- Users rated us459,000+ reviews

- Referred by2.6 lakh+ users3 referrals per minute

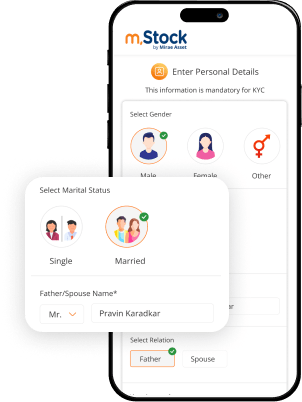

3 simple steps is all it takes

- 1

Enter personal details

- 2

Complete your documentation

- 3

Login and start investing

Start your investment journey

FAQs

What is a Demat account?

The term ‘Demat’ is short for ‘Dematerialisation’, which technically means removing the materialistic aspect of an object. In regard to the share market, dematerialisation of shares means converting the materialistic paper shares to electronic form. So, a Demat account is a virtual locker, similar to a bank account, which stores your financial assets like shares, bonds, ULIPs, Sovereign Gold Bonds (SGBs) etc. in electronic form.

What is a Trading account?

The terms Demat and trading account are used interchangeably, but they are not the same. A Demat account can only hold your securities. Whereas a trading account facilitates the actual buying and selling of the assets. So, your trades (buying and selling) take place through a trading account, but the settlement (debit in case of sell order and credit in case of buy order) happens in the Demat account.

What are the different types of Demat account?

Demat accounts are mandatory for investors who wish to invest in the Indian stock markets. A virtual account, Demat account stores financial assets in electronic form, assisting in seamless and hassle-free trading. There are three basic types of Demat accounts in India – Regular Demat account is opened by resident individuals and is linked with a resident (regular) bank account. The second type of Demat account is called Repatriable Demat account, which is ideal for NRIs who want to invest in the Indian markets from across the globe. As the name suggests, investors can repatriate or transfer funds back to foreign countries, as and when required. A regular Demat account holder will not be able to repatriate funds overseas. A Non-Resident External (NRE) bank account is compulsory when opening a repatriable Demat account. The third type of Demat account is Non Repatriable Demat account, which is also for NRIs but here, funds cannot be transferred back overseas. A Non-Resident Ordinary (NRO) bank account is a must when opening a Non Repatriable Demat account. There is a lesser known fourth type of Demat account – Basic Services Demat account (BSDA). This account is for small retail investors where the value of the assets held in Demat account is less than ₹2 lakhs. The account maintenance charges for BSDA is lower than a regular Demat account.

What are the advantages and features of DEMAT Account?

The primary advantages and features of DEMAT account are as below:

- You can conveniently transfer your shares from one investor to another or one DEMAT account to another.

- You can dematerialise or convert your old share certificates to the electronic form. You can also rematerialise them to the paper form if needed. You need to pay a nominal fee for rematerialisation and dematerialisation, which differs from broker to broker.

- You can enjoy the many corporate benefits associated with investing in market securities. For instance, you can access benefits like dividend payment, interest on investments, refunds, etc., offered by the companies in which you have invested.

- One of the most prominent DEMAT account advantages is that you can avail of loan and overdraft facilities with DEMAT account. You can use your existing securities as collateral to avail of these facilities.

- DEMAT accounts reduce the risk of losing, misplacing, or damaging your investment certificates and proof of investments. You can easily exit or liquidate your investments online with just a few clicks.

- Per SEBI guidelines, you must mandatorily file a nominee or provide a signed declaration if you wish not to register one.

What are the steps to create a Demat account online?

Opening a m.Stock Demat account is a simple, hassle-free process that takes less than 5 minutes. To open m.Stock Demat account:

- Download m.Stock mobile app from Appstore or Play store. You can also visit www.mstock.com

- Click on ‘Open an Account’ button

- Enter your mobile number and submit

- Verify your mobile number with OTP

- Enter and verify your email id with OTP

- Enter your PAN and Date of Birth

- Complete your documentation

- In the next step, you have to upload your selfie and signature.

- Once this is done, add your preferred bank account and verify the same.

- Now fill in your personal details like name, trading experience, nominee details etc.

- If you trade or are planning to trade in Derivatives segment (F&O) then you will have to activate derivatives segment and upload any one proof like 6-month bank statement, salary slip, ITR acknowledgement slip, form 16 etc.

- Then comes the eSign stage. Once your signature is successfully uploaded, your account opening process is complete! You can now reap the benefits of zero brokerage for life!