What is IPO subscription?

IPO subscription indicates how much a particular public issue has been subscribed at both BSE and NSE. Investors can bid for IPO shares on either of the exchanges through the m.Stock app. We provide real-time subscription updates for ongoing IPOs and final bidding details for all IPOs. When a privately held company goes public, it raises funds by offering shares through an IPO. Keeping a track of the IPO subscription status helps investors to gauge the trend in listing gains of the IPOs.

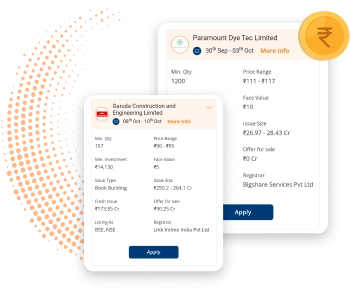

IPO Subscription Status List

| Name | QIB | NII | Retail | Total | |

|---|---|---|---|---|---|

21 Nov | 0.00 | 0.00 | 0.00 | 0.00 | |

27 Dec | 0.00 | 0.00 | 0.00 | 0.00 | |

05 Feb | 0.00 | 0.00 | 0.00 | 0.00 | |

11 Feb | 0.00 | 0.00 | 0.00 | 0.00 | |

Readymix Construction Machinery Ltd 10 Feb | 0.00 | 0.00 | 0.00 | 0.00 | |

10 Feb | 0.00 | 0.00 | 0.00 | 0.00 | |

03 Sept | 0.00 | 0.00 | 0.00 | 0.00 | |

06 Feb | 0.00 | 0.00 | 0.00 | 0.00 | |

07 Feb | 0.00 | 0.00 | 0.00 | 0.00 | |

07 Feb | 0.00 | 0.00 | 0.00 | 0.00 |

FAQs

Why is IPO live subscription data important for investors?

It helps understand the demand of the IPO as higher demand usually results in better listing gains.

The IPO Grey Market rates movement depends on the IPO Subscription Data.

What different categories do IPO investors fall under?

- RII: Retail Individual Investor

- NII: Non-institutional bidders

- QIB: Qualified Institutional Bidders

- Employee

- Others (i.e., shareholders)