Open Demat Account

4 reasons to choose Pay Later (MTF) with m.Stock

- Interest from

6.99%^ p.a.

(0.0192% per day)

- Zero capital

trades with

Pledge Shares

- Unlimited

holding

period

- Up to

80%

funding

^6.99% p.a. above ₹5 crore | 9.99% p.a. up to ₹5 crore

₹1,868 crore+MTF book

₹1,868 crore+MTF book ₹48.74 croreMTF interest saved^

₹48.74 croreMTF interest saved^

^Interest paid by customers as per m.Stock slab (6.99% p.a. & 9.99% p.a.) vs assumed industry average of 14% p.a

Fast. Stable. Secure.

Fast. Stable. Secure.

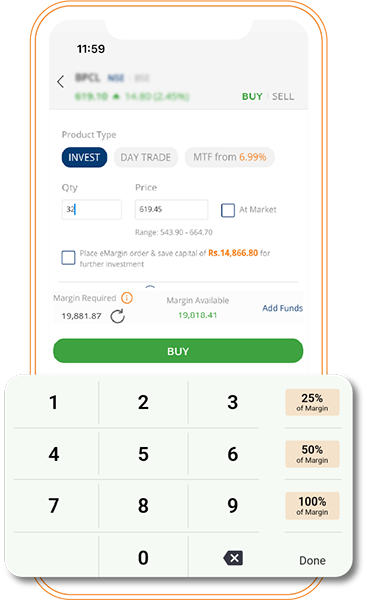

- Smart order form

- Watchlist PRO

- Advanced order types

- Trade from charts

Image is for illustration purposes only.

Smart order form

Select smart filters for

quick buying & selling

m.Stock,

a Mirae Asset brand

Continuing the legacy of delivering innovative financial solutions across 12 countries since 26+ years!

Open your m.Stock Demat Account for free

FAQs

What is Pay Later (MTF)?

Pay Later (MTF) is a leverage product that allows you to get funding from m.Stock for up to 80% of your investment in equity. You can avail Pay Later (MTF) for over 700+ stocks at one of the lowest interest rates starting from 6.99% p.a.

Can new or beginner investors benefit by availing Pay Later (MTF)?

One of the biggest pain points of a beginner in the share market is insufficient capital and by availing Pay Later (MTF), you can overcome this problem. With Pay Later (MTF), beginners can leverage their limited capital and trade big. Especially with m.Stock Pay Later (MTF), as investors get up to 80% funding it becomes easier for a beginner to start investing in more meaningful positions that can also help in maximising the return potential. So, beginners with a capital of ₹10,000 can get funding of ₹40,000, helping them place trades worth ₹50,000. Similarly, beginner investors can place trades worth ₹2,50,000 against a capital of ₹50,000. The funding percentage varies depending upon the stock.